All Categories

Featured

Table of Contents

Term Life Insurance Policy is a sort of life insurance policy policy that covers the policyholder for a certain amount of time, which is understood as the term. The term lengths differ according to what the private chooses. Terms generally vary from 10 to 30 years and increase in 5-year increments, giving level term insurance policy.

They normally provide a quantity of protection for a lot less than permanent kinds of life insurance policy. Like any kind of policy, term life insurance policy has benefits and disadvantages relying on what will certainly function best for you. The advantages of term life consist of cost and the capacity to personalize your term size and coverage amount based upon your needs.

Relying on the sort of plan, term life can use dealt with costs for the whole term or life insurance coverage on level terms. The death benefits can be dealt with. Since it's an inexpensive life insurance policy item and the settlements can remain the same, term life insurance coverage plans are prominent with young people simply starting, family members and individuals who want defense for a details time period.

*** Fees show policies in the Preferred And also Price Class concerns by American General 5 Stars My representative was extremely well-informed and useful in the procedure. July 13, 2023 5 Stars I was satisfied that all my demands were met without delay and expertly by all the representatives I spoke to.

What is What Does Level Term Life Insurance Mean? Learn the Basics?

All documents was electronically completed with access to downloading and install for personal documents maintenance. June 19, 2023 The endorsements/testimonials provided must not be understood as a referral to purchase, or an indication of the value of any kind of product or service. The testimonies are real Corebridge Direct customers that are not affiliated with Corebridge Direct and were not provided payment.

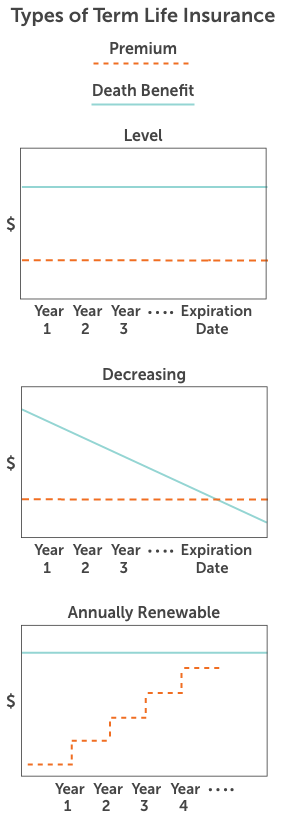

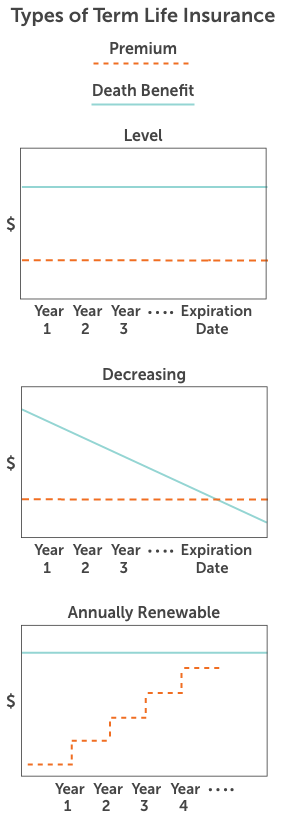

There are several sorts of term life insurance policy policies. As opposed to covering you for your whole life-span like entire life or global life plans, term life insurance only covers you for a marked duration of time. Policy terms generally vary from 10 to thirty years, although much shorter and longer terms might be offered.

If you want to preserve protection, a life insurance company might use you the option to restore the policy for an additional term. If you included a return of premium biker to your policy, you would get some or all of the cash you paid in premiums if you have actually outlived your term.

Degree term life insurance policy might be the very best choice for those that desire coverage for a set amount of time and want their costs to remain steady over the term. This might put on consumers worried about the affordability of life insurance policy and those who do not intend to alter their fatality benefit.

That is because term policies are not guaranteed to pay, while permanent plans are, provided all premiums are paid. Degree term life insurance policy is usually extra expensive than decreasing term life insurance policy, where the death advantage decreases over time. Aside from the type of plan you have, there are numerous various other variables that assist establish the cost of life insurance policy: Older candidates normally have a greater death danger, so they are generally much more pricey to guarantee.

On the flip side, you may have the ability to protect a cheaper life insurance policy rate if you open the plan when you're more youthful. Comparable to advanced age, poor wellness can likewise make you a riskier (and much more costly) candidate permanently insurance. Nonetheless, if the problem is well-managed, you may still be able to locate economical coverage.

What is What Does Level Term Life Insurance Mean? Understanding Its Purpose?

Nevertheless, wellness and age are typically a lot more impactful costs factors than sex. High-risk hobbies, like diving and skydiving, might lead you to pay more permanently insurance coverage. Risky tasks, like window cleansing or tree trimming, may also drive up your expense of life insurance policy. The ideal life insurance policy company and plan will certainly depend on the person looking, their individual ranking variables and what they require from their policy.

The initial step is to establish what you require the plan for and what your budget plan is. Once you have an excellent concept of what you desire, you may desire to contrast quotes and policy offerings from several companies. Some business supply on-line quoting forever insurance, yet numerous need you to get in touch with a representative over the phone or in person.

1Term life insurance policy provides short-term defense for an essential period of time and is usually less pricey than irreversible life insurance. 2Term conversion guidelines and constraints, such as timing, might apply; as an example, there may be a ten-year conversion benefit for some products and a five-year conversion opportunity for others.

3Rider Insured's Paid-Up Insurance policy Purchase Option in New York. 4Not offered in every state. There is a cost to exercise this motorcyclist. Products and cyclists are readily available in accepted territories and names and attributes may differ. 5Dividends are not ensured. Not all participating policy proprietors are qualified for returns. For pick bikers, the problem relates to the insured.

Our term life choices consist of 10, 15, 20, 25, 30, 35, and 40-year plans. The most prominent kind is level term, meaning your payment (premium) and payment (survivor benefit) remains level, or the exact same, until completion of the term period. Term life insurance with accelerated death benefit. This is one of the most simple of life insurance policy alternatives and needs extremely little maintenance for plan proprietors

As an example, you might provide 50% to your partner and divided the remainder among your adult children, a moms and dad, a close friend, or even a charity. * In some circumstances the death advantage might not be tax-free, discover when life insurance coverage is taxed.

What is What Is Level Term Life Insurance? Discover the Facts?

There is no payment if the plan expires prior to your fatality or you live beyond the plan term. You may be able to restore a term plan at expiry, but the premiums will certainly be recalculated based upon your age at the time of revival. Term life insurance policy is normally the the very least costly life insurance policy readily available due to the fact that it offers a survivor benefit for a limited time and doesn't have a money worth component like irreversible insurance - Term life insurance with accidental death benefit.

At age 50, the costs would increase to $67 a month. Term Life Insurance coverage Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life plan, for men and ladies in superb health and wellness.

The lower threat is one element that permits insurance companies to charge reduced premiums. Rate of interest prices, the financials of the insurance coverage firm, and state laws can additionally affect premiums. As a whole, firms frequently supply far better rates at the "breakpoint" coverage degrees of $100,000, $250,000, $500,000, and $1,000,000. When you think about the quantity of coverage you can obtain for your premium dollars, term life insurance policy often tends to be the least expensive life insurance.

Latest Posts

Insurance For Funeral And Burial Costs

Instant Life Insurance Reviews

Minnesota Life Iul