All Categories

Featured

Table of Contents

That typically makes them an extra affordable choice for life insurance policy protection. Many individuals get life insurance coverage to assist financially protect their liked ones in instance of their unanticipated death.

Or you may have the option to transform your existing term coverage into a permanent plan that lasts the remainder of your life. Various life insurance coverage plans have possible advantages and disadvantages, so it's essential to comprehend each prior to you make a decision to purchase a plan.

As long as you pay the premium, your recipients will get the death benefit if you pass away while covered. That said, it is necessary to keep in mind that the majority of plans are contestable for 2 years which means protection could be rescinded on death, must a misrepresentation be discovered in the application. Plans that are not contestable usually have a rated survivor benefit.

What is Level Premium Term Life Insurance Policies and How Does It Work?

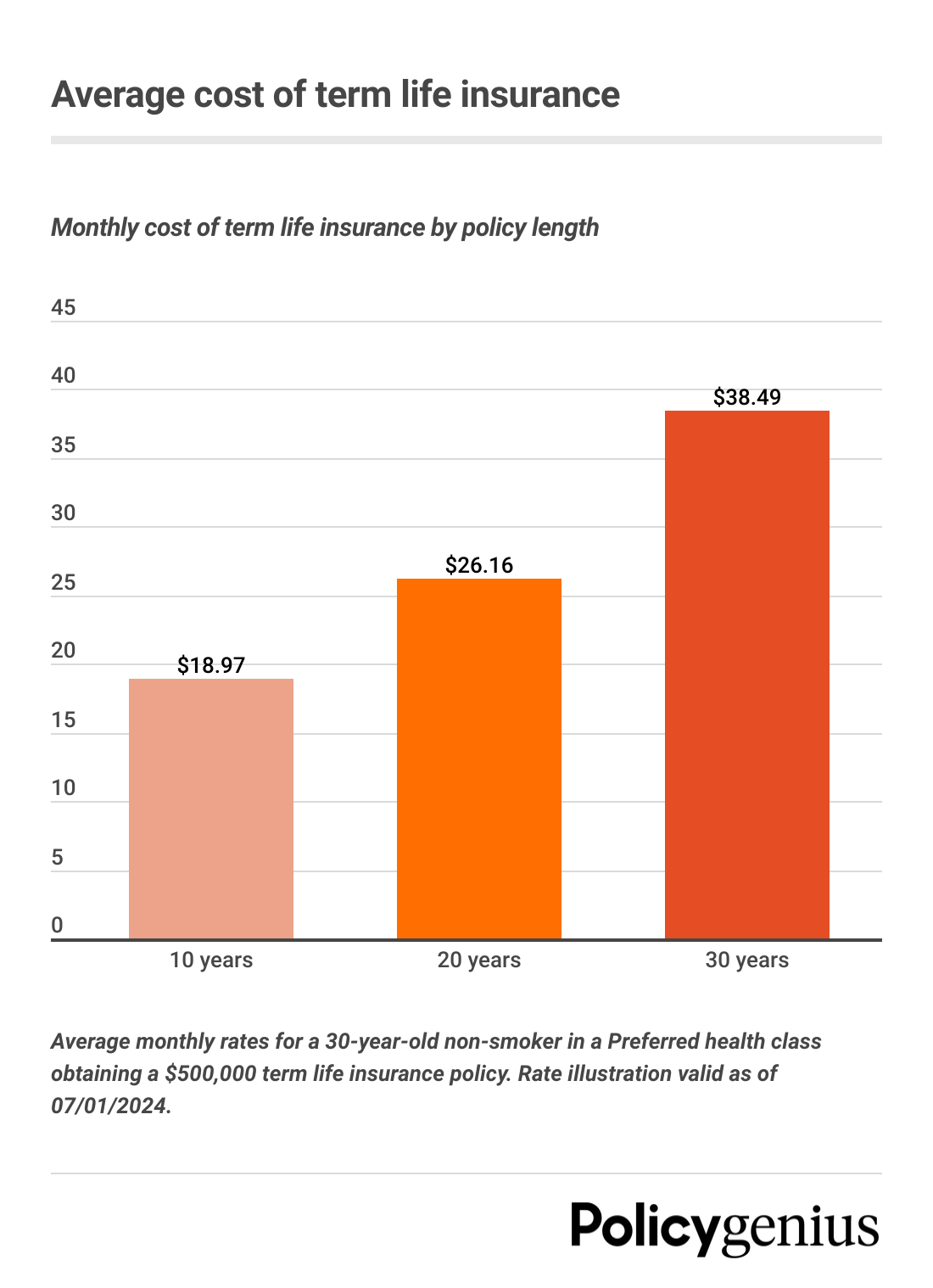

Premiums are usually less than whole life policies. With a degree term plan, you can pick your insurance coverage amount and the plan length. You're not locked into an agreement for the remainder of your life. Throughout your policy, you never need to bother with the costs or survivor benefit quantities changing.

And you can't squander your plan during its term, so you won't get any type of monetary take advantage of your past coverage. As with other types of life insurance, the cost of a degree term plan depends upon your age, protection needs, employment, way of living and wellness. Generally, you'll find a lot more budget-friendly protection if you're younger, healthier and less dangerous to insure.

Given that level term costs stay the same throughout of coverage, you'll recognize exactly just how much you'll pay each time. That can be a huge help when budgeting your expenditures. Level term coverage likewise has some adaptability, allowing you to personalize your plan with extra features. These commonly come in the type of cyclists.

The Basics: What is Term Life Insurance With Accelerated Death Benefit?

You may have to satisfy certain conditions and qualifications for your insurance provider to enact this cyclist. There likewise could be an age or time limit on the insurance coverage.

The death advantage is commonly smaller sized, and insurance coverage typically lasts until your kid transforms 18 or 25. This cyclist might be a much more cost-efficient way to aid guarantee your youngsters are covered as motorcyclists can often cover numerous dependents at the same time. Once your kid ages out of this coverage, it might be possible to convert the rider right into a new policy.

The most common kind of long-term life insurance is whole life insurance coverage, but it has some key distinctions compared to level term insurance coverage. Here's a standard summary of what to take into consideration when contrasting term vs.

What Is Voluntary Term Life Insurance? A Complete Guide

Whole life insurance lasts insurance coverage life, while term coverage lasts protection a specific periodCertain The costs for term life insurance policy are usually reduced than whole life protection.

One of the primary attributes of level term protection is that your premiums and your death advantage do not change. You might have coverage that begins with a death advantage of $10,000, which could cover a home mortgage, and then each year, the fatality advantage will lower by a set quantity or portion.

Due to this, it's often an extra budget friendly sort of degree term coverage. You may have life insurance policy via your company, however it might not be enough life insurance coverage for your needs. The very first step when buying a plan is figuring out just how much life insurance policy you require. Take into consideration factors such as: Age Household dimension and ages Employment status Revenue Debt Way of living Expected final expenditures A life insurance policy calculator can aid establish exactly how much you need to start.

What is a 30-year Level Term Life Insurance Policy?

After choosing on a plan, finish the application. For the underwriting process, you may need to provide basic individual, health, way of living and work info. Your insurance firm will certainly figure out if you are insurable and the danger you may present to them, which is shown in your premium prices. If you're authorized, authorize the documents and pay your first costs.

Lastly, think about scheduling time each year to assess your policy. You might desire to update your recipient info if you've had any significant life adjustments, such as a marital relationship, birth or separation. Life insurance policy can often really feel complicated. But you don't need to go it alone. As you discover your options, take into consideration discussing your demands, desires and worries about a monetary specialist.

No, level term life insurance policy doesn't have money worth. Some life insurance coverage plans have an investment function that enables you to develop money value with time. A portion of your premium repayments is alloted and can earn rate of interest with time, which expands tax-deferred throughout the life of your protection.

You have some options if you still want some life insurance policy coverage. You can: If you're 65 and your coverage has run out, for instance, you might desire to get a new 10-year level term life insurance coverage policy.

Understanding the Benefits of What Does Level Term Life Insurance Mean

You may have the ability to transform your term coverage right into a whole life policy that will last for the remainder of your life. Numerous kinds of level term plans are exchangeable. That means, at the end of your protection, you can transform some or all of your policy to whole life protection.

A degree premium term life insurance coverage strategy allows you adhere to your budget plan while you assist protect your family members. Unlike some tipped price strategies that increases annually with your age, this kind of term plan provides rates that stay the same for the period you pick, even as you age or your health changes.

Find out extra concerning the Life insurance policy alternatives available to you as an AICPA participant (Level term vs decreasing term life insurance). ___ Aon Insurance Coverage Solutions is the trademark name for the broker agent and program administration procedures of Affinity Insurance coverage Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Company, Inc. (CA 0795465); in OK, AIS Fondness Insurance Solutions Inc.; in CA, Aon Fondness Insurance Policy Services, Inc .

Latest Posts

Insurance For Funeral And Burial Costs

Instant Life Insurance Reviews

Minnesota Life Iul